Making Tax Digital for Landlords: Preparing for the April 2026 Changes

Time to read: 15 minutes

Making Tax Digital (MTD) is a UK government initiative aimed at modernising the tax system through digital record-keeping and online submissions. It began with VAT and is now extending to Income Tax Self Assessment. For residential landlords, this means big changes are on the horizon. From 6 April 2026, many landlords will be required to switch to MTD for Income Tax, fundamentally changing how you report rental income to HMRC [1]. This blog post explains what MTD is, what changes are coming in April 2026, who is affected, and how you can prepare. My focus is on practical advice for UK residential landlords, so you can smoothly transition to the new system.

.jpg)

What Is Making Tax Digital (MTD)?

MTD is part of HMRC’s drive to reduce errors and simplify tax filing by moving to digital processes. Under MTD, taxpayers use approved software to keep records and send updates to HMRC, rather than relying on paper or manual online forms. Making Tax Digital for Income Tax is a new way for sole traders and landlords to report their income and expenses to HMRC [2]. Instead of the traditional single annual tax return, MTD will introduce more frequent reporting and a requirement to keep digital records of all income and expenses. The goal is to make tax more transparent and easier to get right. MTD already applies to VAT-registered businesses. The next phase is MTD for Income Tax Self Assessment (MTD ITSA), which affects unincorporated businesses and landlords. Starting April 2026, certain individual landlords in the UK will come under these new rules. Below, we outline exactly what changes on 6 April 2026 and what it means for you as a landlord.

What’s Changing from April 2026?

Beginning 6 April 2026, MTD for Income Tax becomes mandatory for individuals with higher rental or business incomes. Specifically, if you are a landlord (or sole trader) and your total gross income from property and/or self-employment is over £50,000 per year, you will have to comply with MTD rules from that date[3]. Importantly, that £50,000 threshold is based on gross income (before expenses), and it only counts income from self-employment and property rental. Other income like employment wages or pensions are not counted toward the £50k threshold. This means, for example, if you received £55,000 in rent during the year but had £15,000 of landlord expenses (so £40k profit), you still cross the threshold because your gross rental income was £55k, above £50k. Only rental and sole trader business income are considered; salary, pension, dividends, etc. are excluded for MTD threshold purposes. The £50,000 threshold relates to income in the tax year 2024/25 to determine if you must join MTD in April 2026 [4]. This is just the first phase. The government has announced that the threshold will then drop to £30,000 (gross self-employment + property income) from April 2027, and potentially to £20,000 by 2028, bringing more landlords into MTD over time. For now, April 2026 targets landlords with £50k+ in relevant income, which will include many with multiple or high-rent properties.

Timeline

Who Is Affected

It’s also crucial to clarify who is and isn’t affected. MTD for Income Tax applies to individuals (landlords and sole traders) who file Self Assessment tax returns. It does not apply to income that is handled via a limited company. If you own rental property through a company, that company pays Corporation Tax and is not subject to MTD for Income Tax (companies will have their own digital filing requirements later, but not in this April 2026 change). In short, residential landlords operating as individuals are the focus of the April 2026 MTD rules – not corporate landlords.

Finally, note that if you are new to landlording around that time, HMRC generally won’t force you into MTD until after you’ve filed your first Self Assessment in the old way. But once you’re in scope (met the income threshold in a prior year and have filed an SA return), you’ll need to comply from the next tax year.

.jpg)

What Will Landlords Need to Do Under MTD?

If you meet the criteria in April 2026, here’s what complying with MTD for Income Tax will involve:

1. Register for MTD and Compatible Software

Affected landlords will need to sign up for the MTD service (this is done through an HMRC online process). HMRC has said it will contact those who appear to be mandated, but registration is not automatic – you must take action to enroll [6]. To use MTD, you’ll also need to choose MTD-compatible software. HMRC does not provide the software; you must use a commercial accounting or record-keeping tool that is recognized by HMRC for MTD. This software is how you will keep records and communicate with HMRC’s system. Many software providers (from well-known accounting packages to landlord-specific apps) are available, which we’ll list later. Once you have software, you or your accountant will link it to your HMRC account (using your Government Gateway ID) and authorize it for MTD.

2. Keep Digital Records of Income and Expenses

Under MTD, paper records or purely manual bookkeeping will no longer suffice. You must use digital records to track all your business and rental income and expenditure. That means recording every rent payment, expense, invoice, etc., in an electronic form. Your chosen software will create and store digital records of your self-employment and property income and expenses [7]. You should get in the habit of logging transactions regularly. Some software can import data from your bank or let you scan receipts to simplify this. The key is that by the time you need to report, all data should be stored digitally in the system. (You’ll also be required to retain these digital records for at least 5 years after the tax year, similar to current rules for keeping records [8].)

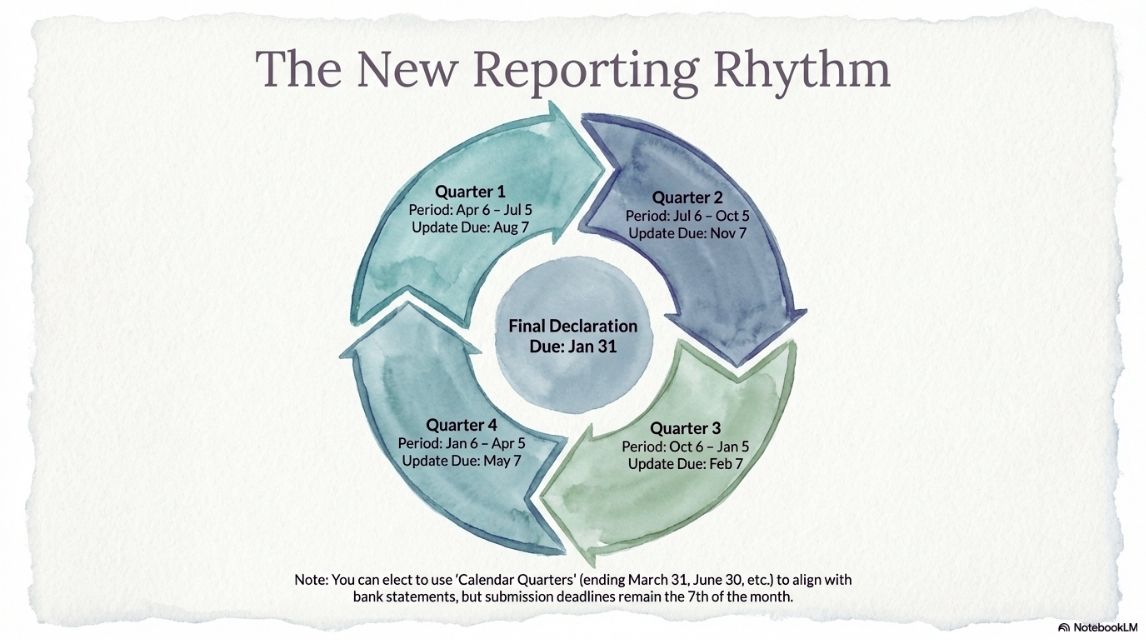

3. Submit Quarterly Updates

Rather than one annual return, you will send four summaries per year to HMRC, each covering a quarter of the tax year. Using your MTD software, you’ll send quarterly updates to HMRC that include a summary of your income and expenses for that period [7]. The quarters are expected to follow the tax year cycle. For example, Q1 would cover 6 April to 5 July, Q2 covers the next three months, and so on. Each update is due one month after the quarter ends. For instance, the first MTD quarterly report (6 April – 5 July 2026) must be filed by 7 August 2026 [9]. Subsequent quarters would be due by 7 November, 7 February, and 7 May respectively for a standard 6 April – 5 April tax year cycle. Mark these dates, because meeting them is important – there will be a new penalty points system for late submissions (more on that later). The quarterly updates themselves are relatively simple – essentially just totals of income and categories of expenses. You won’t calculate tax due at this stage; it’s more like providing HMRC with periodic snapshots of your figures. In return, HMRC may provide an estimated tax liability based on the info submitted, so you have an idea of what your eventual bill might be [8].

4. Final Year-End Submission (End of Period Statement & Declaration)

At the end of the tax year, you will need to “finalise” your tax year data and submit a final declaration to HMRC via the software. This final submission is effectively replacing the traditional Self Assessment tax return [10]. It will pull together all the data from your quarterly updates, allow you to make any accounting adjustments or claim reliefs as needed, and then ask you to confirm the year’s totals in a final declaration. This is sometimes called an End of Period Statement (for each business source) and a Final Declaration for the overall tax year. In practice, your software will guide you through this process. The deadline for the final year-end submission will remain 31 January following the end of the tax year, same as the current SA deadline[7]. You’ll also pay any Income Tax due by that 31 January date as usual. Essentially, you’re still doing an annual true-up of your tax, but it’s done through the MTD software and after sending the quarterlies.

In summary, landlords using MTD will be doing: digital bookkeeping, quarterly income/expense reports, and an annual final declaration (instead of the old Self Assessment form) – all via compatible software [7]. If you use an accountant or tax agent, they can continue to assist or even handle submissions on your behalf, but they will also have to use MTD software to do so. The new system means more frequent interaction with HMRC, but each interaction should be more streamlined.

How UK Landlords Can Prepare (Practical Tips)

Transitioning to MTD may sound daunting, but with some preparation you can make it a smooth process. Here are some practical steps and tips for residential landlords to get ready:

Determine if and when you’re affected

First, figure out if the rules from April 2026 actually apply to you. Look at your total rental (and self-employment) income for the 2024–25 tax year. If it’s £50,000 or above, you’ll be in the first group mandated to use MTD from 6 April 2026 [11]. If you’re below £50k, MTD isn’t compulsory for you yet – but note the threshold will drop in subsequent years. Even if you’re not required in 2026, keep an eye on your income levels for 2025–26 (threshold £30k) and 2026–27 (£20k planned) to see when you might be pulled in. It’s also possible to opt in voluntarily before you’re forced – some landlords under the threshold may choose to use MTD early to get a head start or if it simplifies their process [11].

Educate yourself on MTD now

Don’t wait until the last minute. Take time now to read HMRC’s guidance and understand the new obligations. HMRC and landlord associations have published guides and even toolkits to help taxpayers prepare[12]. These explain who needs MTD, how to keep records, and how to sign up. By familiarising yourself early, you’ll be more confident when the time comes. If you use a tax adviser or accountant, discuss MTD with them in advance – ensure they will support you through the change.

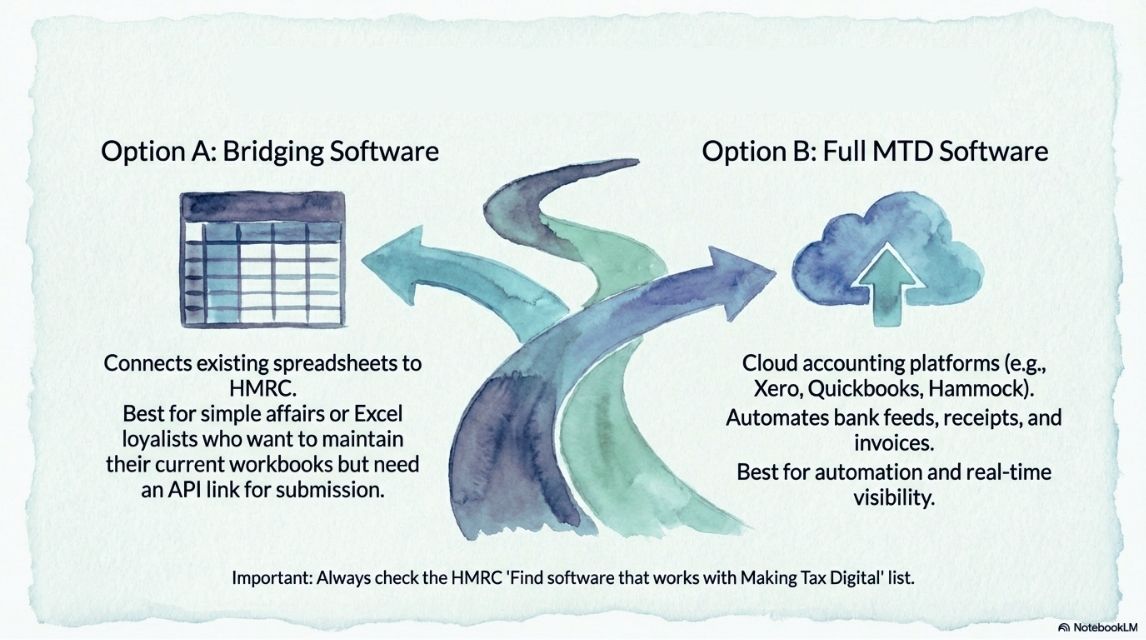

Choose MTD-Compatible Software early

A critical step is selecting the software you’ll use to comply. There are many MTD-compatible software tools (see list at the end of this post). Some are general bookkeeping or accounting packages (like QuickBooks, Xero, etc.), and others are tailored specifically for landlords’ needs (for example, property management accounting apps). All MTD software must meet HMRC’s requirements to record data and exchange information with HMRC’s systems. Start researching which software suits you best well before April 2026. Many offer free trials or demos – take advantage of that in 2025 so you can test how to input your rental income, enter expenses, and generate the required reports. Make sure the software can handle multiple properties if you have them, and that it can distinguish between different income sources (e.g., if you also have a sole trade business). HMRC provides an official list of compatible software and features to look for [13]. Pick one that feels comfortable for you, and get it set up early.

Begin digital record-keeping now

To avoid a last-minute scramble, consider shifting to digital record-keeping as soon as possible, even before it’s mandatory. If you currently keep paper records or Excel spreadsheets for your rents and expenses, start using your chosen software (or at least an interim digital system) for the new tax year ahead. This will help you iron out any kinks. For instance, you could start scanning receipts or invoices and logging them digitally each month. Many MTD software products allow you to connect your bank account feeds, so rent payments and expense transactions import automatically [14][15]. Setting this up in advance means by 2026 you’ll have a routine. Good digital habits – like updating your books monthly or even in real-time – will make quarterly reporting much easier. The goal is to have up-to-date, accurate records at the end of each quarter so generating the HMRC update is a quick task.

Mark your calendar with new deadlines

MTD introduces new filing dates that landlords never had to worry about before. It’s vital to remember the quarterly submission deadlines and plan around them. In each tax year, you’ll have four filing due dates: 7 August, 7 November, 7 February, and 7 May (assuming quarters ending 5 July, 5 October, 5 January, 5 April respectively) [16]. Put reminders in your calendar, set phone alerts, or use your software’s reminder features so that you don’t miss these. While the year-end final declaration is still due by 31 January, the quarterly deadlines spread obligations through the year. Timely compliance is important because HMRC is introducing a penalty points system: every missed quarterly deadline earns a point, and accumulating four points will trigger a £200 fine[17]. In short, don’t treat the quarterlies casually – set up a system to ensure each update is submitted on time (even if some figures are provisional and can be adjusted later in the year-end step).

Get support if you need it

Not every landlord is an accounting expert or tech-savvy, and that’s okay. The key is not to ignore MTD. If you feel overwhelmed, seek assistance. This could mean hiring a bookkeeper or accountant to handle your record-keeping and submissions. Many accountants are gearing up for MTD and can offer services to manage the quarterly filings for you (for a fee). Even some letting agents or property managers might expand their offerings to help landlords with MTD filings [18] – it’s worth asking if you already work with one. HMRC’s systems also allow an agent (accountant) to file on your behalf, similar to how they might currently submit your Self Assessment. Just ensure any agent you use is informed about MTD requirements. If you prefer a do-it-yourself approach, consider investing a bit of time in training: some software providers have tutorials, and landlord associations (like NRLA) offer courses on MTD. Remember that once you’re comfortable with your software, much of the process can be automated or at least made routine.

Prepare for changes to your workflow

MTD will likely require a mindset shift. Instead of the old yearly rush to compile your tax info, you’ll be maintaining records throughout the year. This can actually be a good thing – many landlords might find it provides better visibility into their finances. To adapt, set a regular schedule for admin. For example, dedicate an hour each week or a day a month to update your books so you’re always MTD-ready. Ensure you separate personal and business finances (e.g., using a separate bank account for rent and expenses can make tracking easier). Think about your accounting basis as well: most landlords use the cash basis (recording income when received and expenses when paid) which is allowed up to £300k turnover [19]. Confirm that your software is set to the correct accounting basis and that you’re consistent with it. Little steps like these will smooth out the quarterly reporting process.

By taking these preparatory steps, you’ll reduce the stress of the transition. Landlords who plan ahead and get comfortable with digital tools will likely find MTD becomes just a routine part of property business, rather than a burden.

Conclusion

MTD for Income Tax represents a significant change for UK residential landlords, but it doesn’t have to be a nightmare. It’s essentially about bringing tax reporting into the digital age. Starting April 2026, if you have a total rental and business income over £50k, you’ll be keeping records digitally, sending HMRC summary updates every quarter, and wrapping up the year with an online final submission [9]. This applies to individual landlords (not companies) and will eventually encompass even more landlords as the thresholds lower.

The best approach is to be proactive: know when you need to join, have the right software in place, and develop a habit of maintaining your records regularly. While there’s an adjustment period, MTD could bring some benefits – like more up-to-date knowledge of your tax position and fewer surprises at year-end. And with the right tools (and advice if needed), the compliance process can be quite streamlined.

Remember that HMRC’s aim is to make tax easier (for themselves) and reduce errors. By April 2026, give yourself the time to get set up and familiar with the new system. Once you do, quarterly reports and digital record-keeping will become just another part of managing your property business. Stay informed through HMRC updates or reputable sources (e.g. gov.uk guidance and landlord associations), and don’t hesitate to get support. With preparation, you’ll be ready to tackle MTD and keep your rental business compliant and efficient in the digital tax era.

%20for%20Income%20Tax%20Mind%20Map.png)

Choose the right software for Making Tax Digital for Income Tax – GOV.UK https://www.gov.uk/guidance/find-software-thats-compatible-with-making-tax-digital-for-income-tax

CHALLENGE Yourself – Take a Quiz

Check also article: The 2026 Digital Tax Shake-Up: 8 Surprising Realities Every UK Landlord Must Face

Read more:

- The 2026 Renters’ Rights Reality: Preparing Your Portfolio for the New Regulatory Landscape

- The 2026 Digital Tax Shake-Up: 8 Surprising Realities Every UK Landlord Must Face

- What Is Rental Yield and Why It Matters for Landlords

ツ Never miss a post. Sign up for our newsletter.

No spam promise. You can unsubscribe anytime.