The 2026 Digital Tax Shake-Up: 8 Surprising Realities Every UK Landlord Must Face

Time to Read: 7 minutes

1. Introduction: The End of the “January Panic”

For decades, the UK landlord’s calendar has been defined by the “January Panic”—the stressful, late-night scramble to gather crumpled receipts and bank statements before the January 31st Self-Assessment deadline. I have seen this cycle repeat year after year. However, we are now entering a new era.

Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) represents the most significant shift in UK tax administration since the introduction of Self-Assessment in 1996. It moves the burden from a single annual event to a proactive, quarterly digital cycle. While the headlines focus on the 2026 rollout, the strategic shift begins much sooner. Understanding these changes is not just about compliance; it is about ensuring your property business remains viable in a digital-first environment.

2. The 2024/25 “Judgment Year” and the Combined Threshold

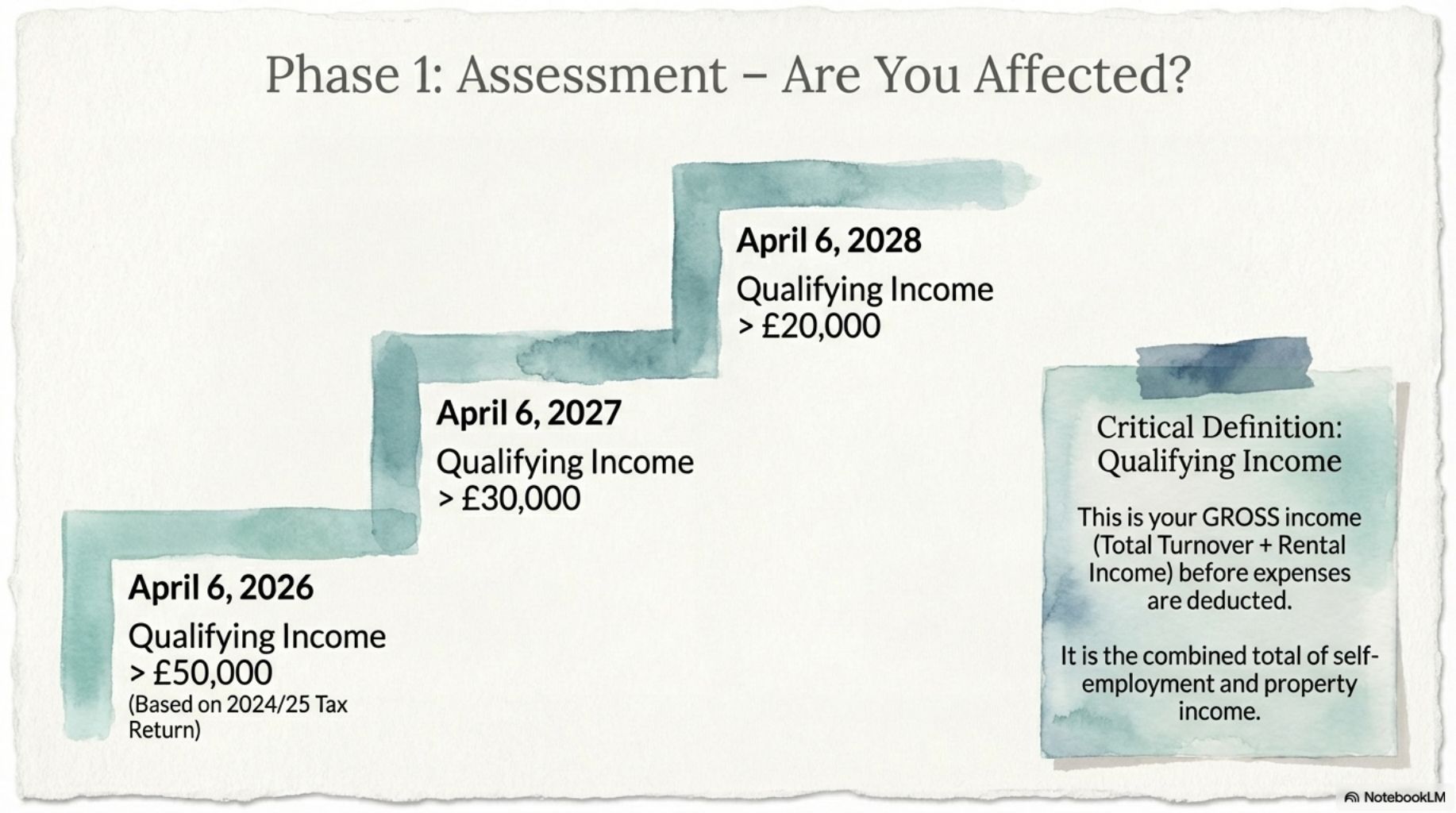

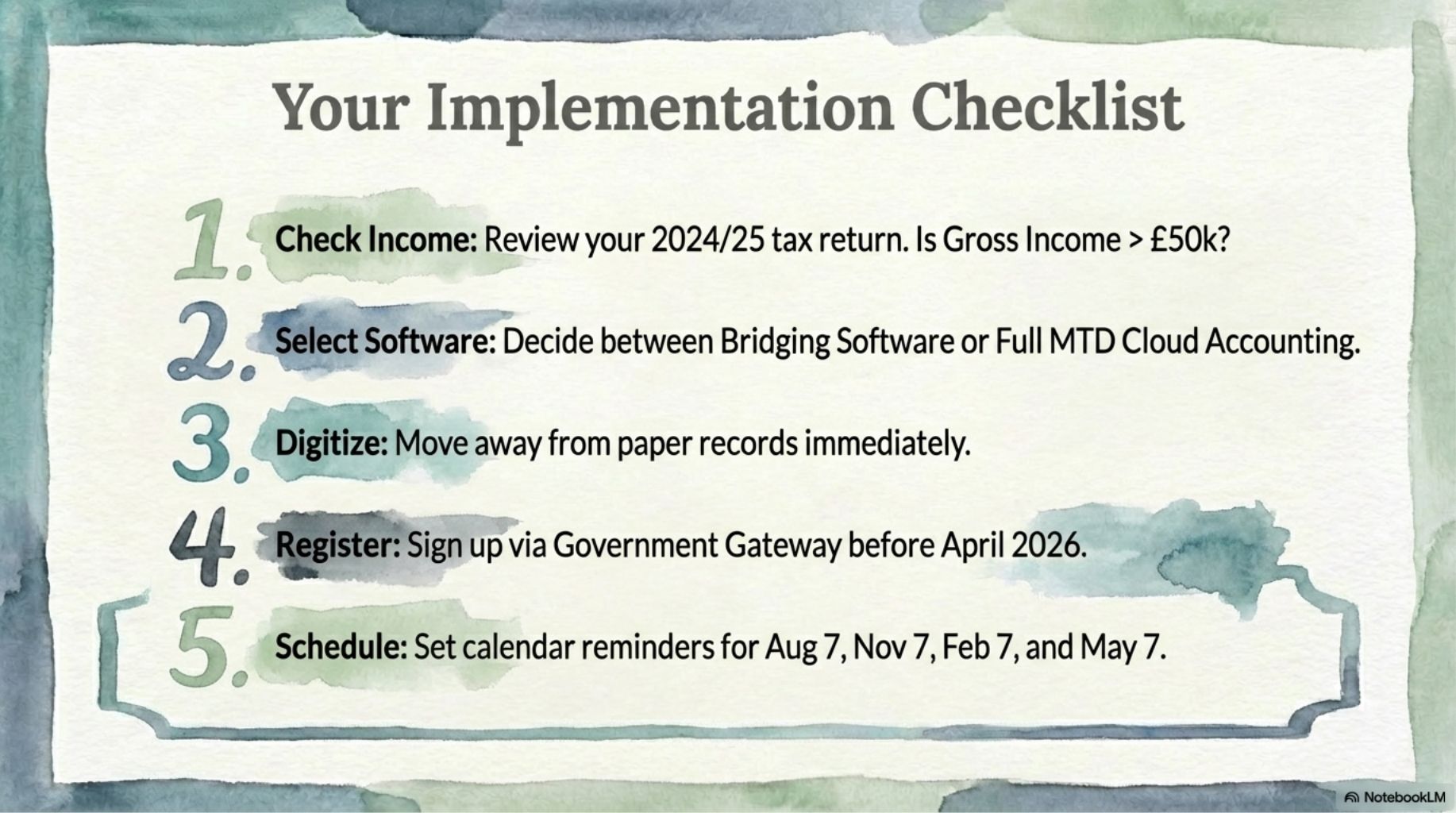

Many landlords believe they have plenty of time because the mandate begins in April 2026. This is a dangerous misconception. From a compliance standpoint, your “judgment year” is the 2024/25 tax year. HMRC will review the tax return you submit by January 31st, 2026, to determine if you are mandated for the April 2026 start. If your gross qualifying income exceeds £50,000 in that return, you are in.

Furthermore, the £50,000 (2026), £30,000 (2027), and £20,000 (2028) thresholds apply to gross qualifying income before any expenses. If you earn £26,000 in rent and £25,000 from a sole-trader business, your combined income of £51,000 mandates you for Phase 1. Crucially, this creates a dual reporting burden: you would be required to submit two separate updates every quarter—one for the sole-trader business and one for the rental business—totalling eight submissions a year before even reaching your Final Declaration.

3. The Death of the Furnished Holiday Let (FHL) Advantage

The specialized tax regime for Furnished Holiday Lets will be abolished in April 2025. This change precedes MTD but fundamentally alters the profitability of short-term lets.

| Old FHL Benefits (Pre-April 20250 | New Reality (Post-Abolition) |

|---|---|

| Capital Allowances: Deduct full setup and plant/machinery costs (e.g., hot tubs, furniture). | Replacement of Domestic Items: Relief only for replacing existing domestic items. Initial setup is capital-heavy. |

| Mortgage Interest: Full deduction from profits. | Interest Relief: Limited to a 20% tax credit, significantly increasing the tax bill for higher-rate payers. |

| Pension Contributions: Profits count as relevant earnings for tax-relieved contributions. | Pension Impact: Rental income no longer qualifies as earnings for pension purposes. |

| CGT Reliefs: Access to Business Asset Disposal Relief (10% rate). | Standard CGT: Standard residential property rates apply upon sale. |

| Strategic Tip: | Impact Assessment: High-geared portfolios (high mortgages) may become loss-making. Review your portfolio viability immediately. |

4. The Joint Ownership “Easement” Interaction

HMRC has introduced “easements” to simplify reporting for those who own property with a spouse or partner. These rules allow joint owners to choose more streamlined reporting paths:

- Summary Reporting: You can submit one total income figure per quarter rather than a detailed breakdown.

- Annual Expense Reporting: You can opt to report expenses only once annually in the Final Declaration, reducing quarterly admin.

However, be mindful of the Rent-a-Room interaction. Receipts below the £7,500 threshold are typically ignored for MTD purposes. But, if you have other UK property income that puts you over the MTD threshold, you must include the rent-a-room data in your digital records and quarterly updates if you have claimed relief for it on your last return.

5. Overseas Landlords: Distance is No Defense

If you reside abroad but receive UK rental income above the threshold, residency status is not a shield against digital compliance. MTD for overseas landlords operates side-by-side with the Non-Resident Landlord (NRL) Scheme.

“MTD for overseas landlords does not replace the NRL Scheme. Both operate side by side.”

The strategic risk here is your Gross Payment Status (NRL1). If you fail to stay compliant with MTD quarterly updates, HMRC may view this as a failure to keep your tax affairs up to date. This could result in the revocation of your right to receive rent without tax deducted. If your agent is forced to deduct 20% tax at source, it will cause immediate and devastating cash-flow issues.

6. The £90k Simplified Reporting and the “Nil Return” Requirement

There is a persistent myth that quarterly updates are “mini-tax returns” requiring full audits. They are, in fact, “unadjusted summaries” of income and expenses. Two technical nuances are critical here:

- The £90,000 Threshold: If your total gross income is below £90,000, you are eligible for “three-line accounting.” You can simply categorize items as “income” or “expense” without the detailed breakdowns required for larger businesses.

- The Nil Return Trap: Even if your property is vacant or you have zero transactions in a quarter, you must still submit a “nil return.” Skipping a quiet quarter will earn you a penalty point just as surely as a late filing would.

7. The Points-Based “Soft Landing”

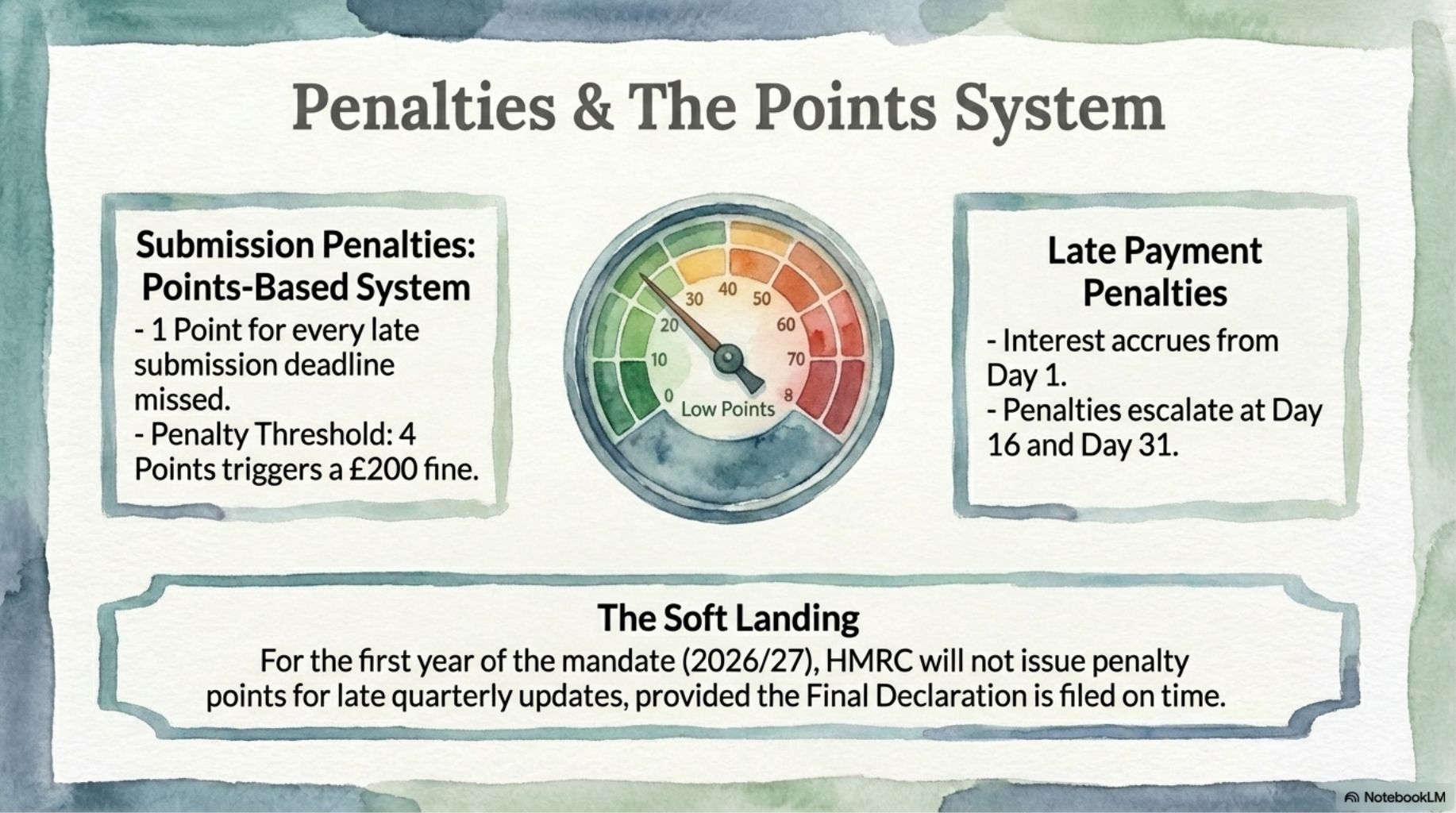

HMRC’s new penalty system is, thankfully, more focused on persistent lateness than one-off errors. You earn one point for each missed deadline. For quarterly filers, a £200 fine is only triggered once you reach four points.

I find the “soft landing” for the 2026/27 cohort particularly reassuring: you will not receive penalty points for late quarterly updates in the first year. This is designed to let you acclimate to the software. However, do not be lulled into a false sense of security—there is no grace period for the Final Declaration. Missing the January 31st, 2028, deadline will result in immediate penalty points.

8. Conclusion: Choosing a Bridge, Not an Anchor

MTD marks a fundamental transition from reactive to proactive tax management. To navigate this, you must select HMRC-recognized software that fits your specific needs. From my review of the current market:

- Xero – A cloud-based accounting software that supports MTD for Income Tax, suitable for landlords and small businesses.

- QuickBooks Online – A well-known online accounting platform by Intuit, offering MTD compliance for income tax with easy expense tracking and reporting.

- Sage Accounting – Accounting software (formerly Sage One) with MTD capabilities, useful for landlords who want straightforward bookkeeping and submission features.

- FreeAgent – An online accounting tool (free with some UK business bank accounts) that is MTD-ready and has specific features for landlords and sole traders.

- Landlord Studio – A property-focused finance app designed for landlords, officially recognised by HMRC for MTD. It helps track rent, expenses, and lets you file the required updates easily.

- Hammock – A specialist landlord accounting platform (also HMRC-recognised for MTD) that connects to your bank to monitor rental income and expenditures and facilitates quarterly filings.

- RentalBux is the premier choice for landlords with complex profit-sharing or joint ownership structures, as it handles intricate income splits that standard accounting software misses.

- TaxNav is an excellent “bridging” solution for those who wish to maintain their existing spreadsheets while ensuring they can submit the required API data to HMRC.

My Favourites:

- QuickFile – A UK-based cloud accounting platform supporting MTD for Income Tax, tailored to residential landlords through a dedicated module. It allows easy digital tracking of rental income and expenses and lets landlords file quarterly tax updates to HMRC from one platform, streamlining compliance with MTD requirements.

- ClearBooks – An online accounting software fully compliant with MTD for Income Tax, designed to simplify rental bookkeeping for landlords. It offers an intuitive interface for tracking rent and property expenses and allows one-click submission of quarterly updates to HMRC, making MTD compliance straightforward for rental income reporting.

Is your current bookkeeping system a bridge to the future, or an anchor holding you back from a deadline that is much closer than it appears?

The time for strategic preparation is now.

Disclaimer: This article is for general information only and is based on rules and proposals as at February 2026. Tax law and HMRC practice can change, and you should obtain professional advice for your specific circumstances.

Download checklist – Making Tax Digital (MTD) for Landlords

Are you ready for MTD (Making Tax Digital)?

Take A Quiz!

ツ Never miss a post. Sign up for our newsletter.

No spam promise. You can unsubscribe anytime.