The 2026 Renters’ Rights Reality: Preparing Your Portfolio for the New Regulatory Landscape

Time to read: 6 minutes

Introduction: The End of the Status Quo

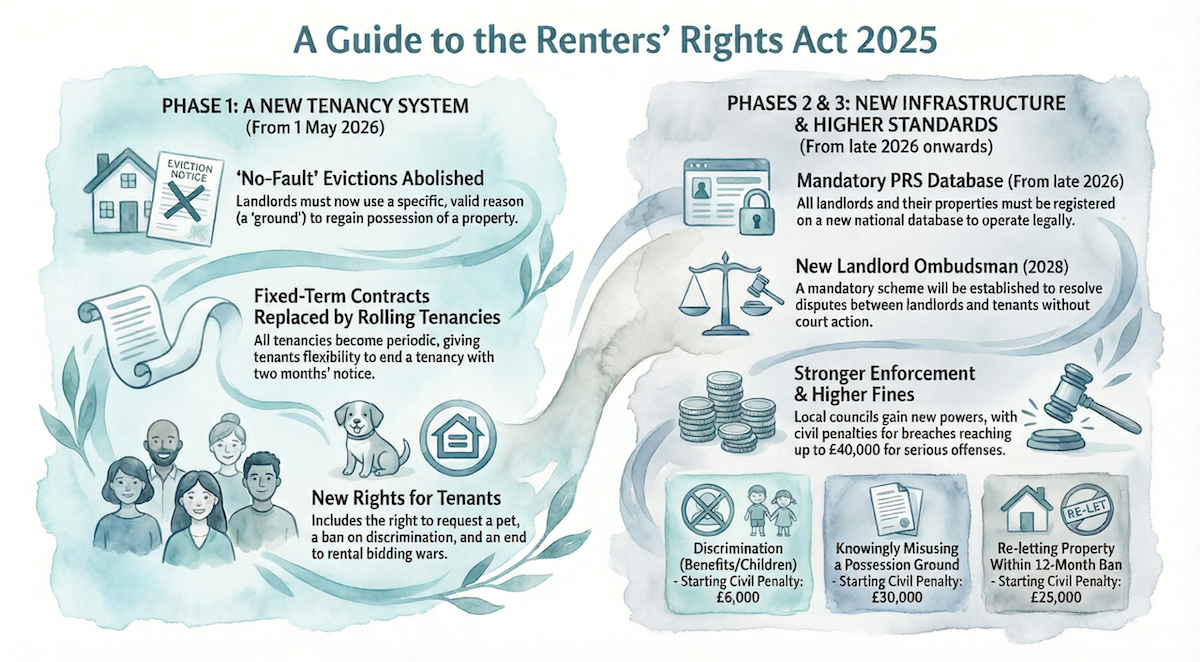

1 May 2026 marks a turning point for landlords in England. It is the most significant change to the private rented sector in decades.

For years, landlords relied on Assured Shorthold Tenancies (ASTs). Fixed terms and Section 21 created predictability. However, that framework ends when the Renters’ Rights Act 2025 comes fully into force.

While most headlines focus on the removal of Section 21, the real risk sits elsewhere. New possession limits, rent controls, and enforcement rules now work together. As a result, small administrative mistakes can carry serious consequences.

This post explains the core changes landlords must address before May 2026.

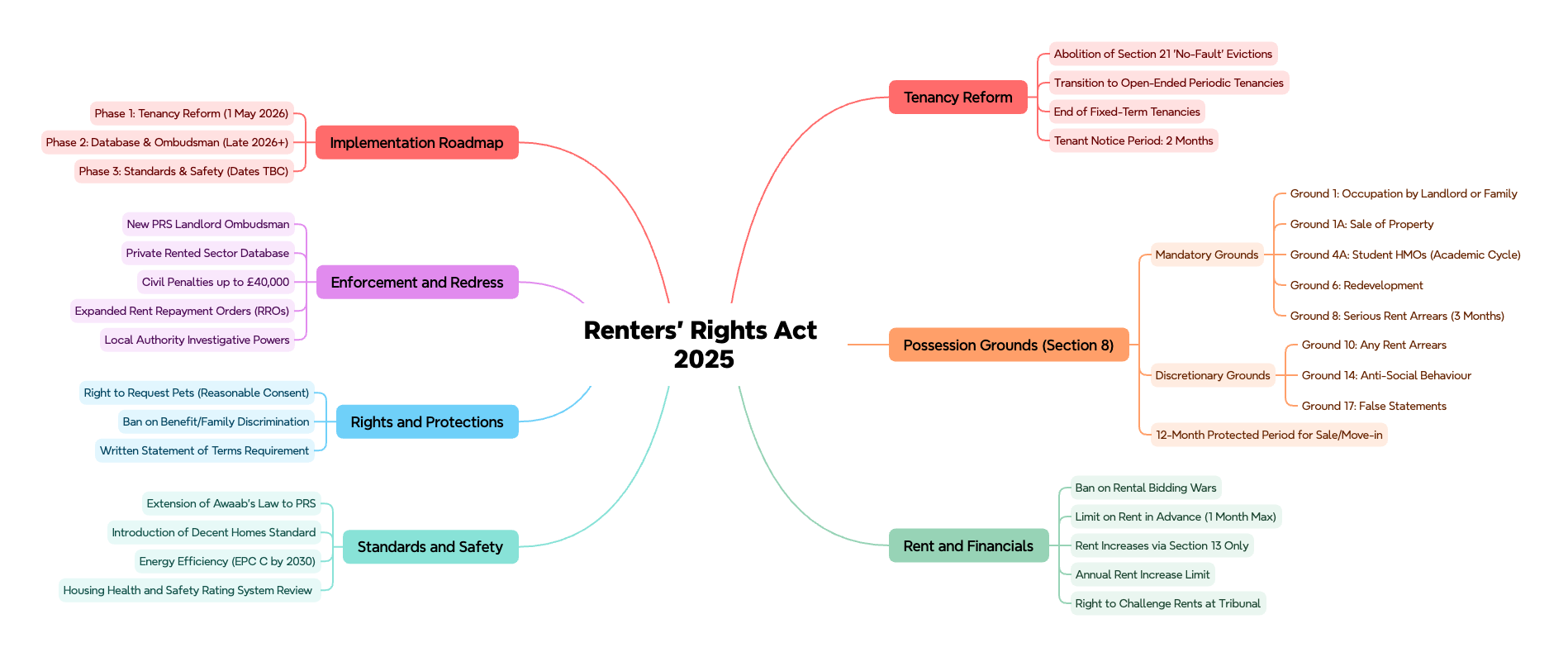

Fixed Terms Are Ending: Why Periodic Tenancies Become the Default

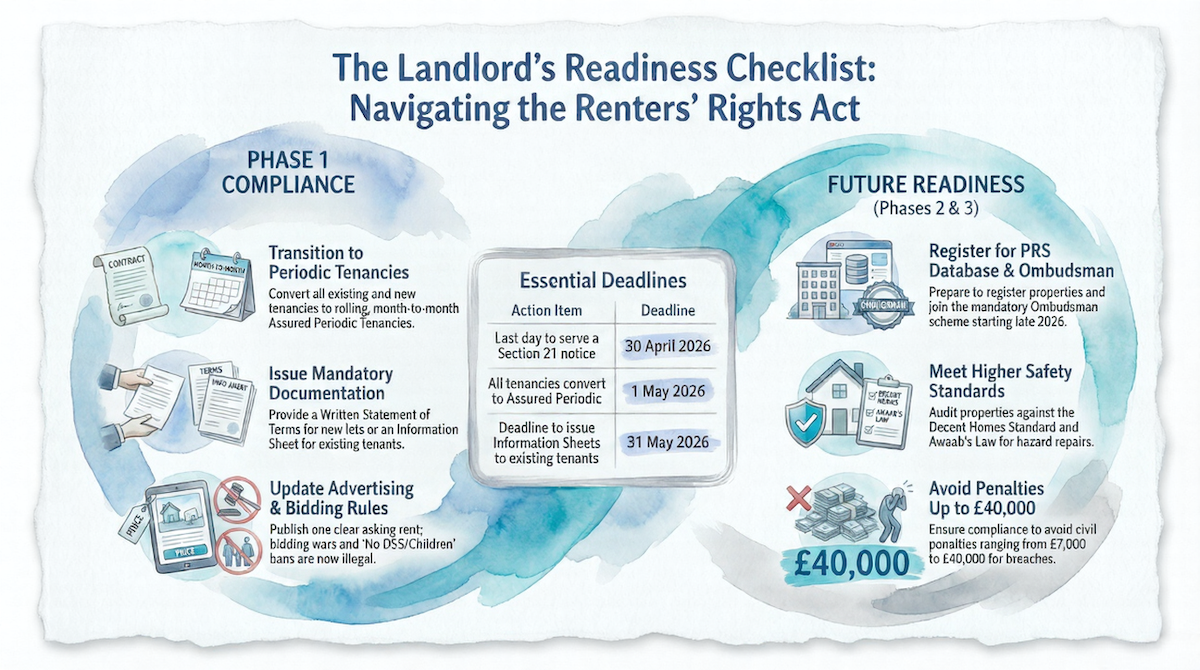

From 1 May 2026, fixed-term tenancies will disappear from the private rented sector. All new and existing assured tenancies convert to a mandatory periodic structure.

This means landlords can no longer lock tenants into 12- or 24-month terms. Instead, tenants can end a tenancy at any point by giving two months’ notice, aligned with the rent period.

What About Student Lets?

There is one important exception. Purpose-Built Student Accommodation remains largely outside the assured tenancy system. In addition, traditional student HMOs receive limited protection.

Under Ground 4A, landlords may still recover possession in line with the academic year. However, this only applies if:

- the property is a registered HMO

- it is let to full-time students

- notice is served correctly

Outside student housing, landlords lose contractual control. Therefore, long-term performance now depends on service quality and compliance rather than tenancy wording.

The 12-Month Possession Shield: A New Liquidity Risk

The Act introduces a strict 12-month possession protection period.

Under Ground 1 (landlord occupation) and Ground 1A (sale), landlords cannot even serve notice during the first year of a tenancy. In addition, these grounds require four months’ notice.

As a result, a landlord may wait up to 16 months before regaining possession.

This creates a liquidity problem. If your circumstances change or market conditions shift, you cannot exit quickly. Therefore, short-term or flexible investment strategies now carry higher risk.

Rent Bidding Bans and Annual Caps: Pricing Errors Become Costly

The Act also reshapes the rent setting.

Landlords and agents must now advertise a single, fixed rent. They cannot invite, encourage, or accept offers above that figure. In addition, all contractual rent review clauses become invalid.

Instead, landlords must use Section 13 notices, limited to once per year and capped at market rent.

Because of this:

- pricing too low locks income for 12 months

- pricing too high increases void risk

Moreover, councils can enforce breaches using the balance of probabilities test. This lower threshold makes penalties easier and more frequent.

Rent Arrears: Higher Thresholds, Longer Delays

The financial risk of arrears increases significantly under the new rules.

Mandatory Ground 8 now requires three months of arrears instead of two. The notice period also doubles from two weeks to four.

At the same time, landlords can no longer request more than one month’s rent in advance. This removes a key risk-management tool for tenants with unstable income.

When combined, these changes mean a tenant could fall four months behind before a claim even begins. Therefore, robust referencing and rent guarantee insurance become essential rather than optional.

Mandatory Registration: The Database and Ombudsman

Phase 2 of the Act, expected later in 2026, introduces two compulsory systems:

- the Private Rented Sector Database

- a mandatory Landlord Ombudsman

Every landlord must register, even if they use an agent.

The database will hold safety documents such as gas certificates, electrical reports, and EPCs. Crucially, landlords must keep records active. If an entry lapses, most possession grounds become unavailable.

This marks the end of passive ownership. From 2026 onward, compliance must be continuous and auditable.

Enforcement and Penalties: Why Compliance Now Has “Teeth”

The enforcement model is designed to fund itself. As a result, local authorities have a strong incentive to act.

Penalties fall into three main categories:

- Civil penalties (up to £7,000)

Applied on the balance of probabilities for rent bidding, rent-in-advance breaches, and discrimination. - Serious breaches (up to £40,000)

Applied where criminal standards apply, including database manipulation or ombudsman avoidance. - Rent Repayment Orders

Extended to a maximum of 24 months’ rent. Tenants can now apply directly for misuse of possession grounds.

Action Plan: What Landlords Should Do Now

With Phase 1 starting on 1 May 2026, preparation time is limited. Success depends on moving from reactive fixes to structured compliance.

Priority Actions Checklist

- Review exit strategies

Account for the 12-month service ban and four-month notice periods. - Issue the Information Sheet

For tenancies that exist before 1 May 2026, provide the government Information Sheet by 31 May 2026. - Audit for Awaab’s Law

Prepare for Decent Homes enforcement. Investigate reported hazards within 10 working days. - Switch to Section 13 rent reviews

Identify invalid rent clauses and prepare to use statutory notices only.

Final Thought

The Renters’ Rights Act does not end landlord profitability. However, it does end informal systems and reactive management.

Landlords who adapt early will retain control. Those who delay may lose it.

From April 2026, many landlords will move to mandatory digital tax reporting.

Read:The 2026 Digital Tax Shake-Up — 8 Realities Every UK Landlord Must Understand

ツ Never miss a post. Sign up for our newsletter.

No spam promise. You can unsubscribe anytime.